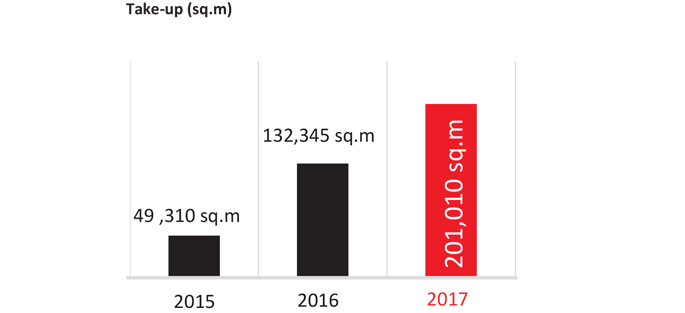

Take-up for light industrial space in Marne-la-Vallée reached more than 200,000 sq.m in 2017, a new record for the area and an increase of 50 % compared to 2016.

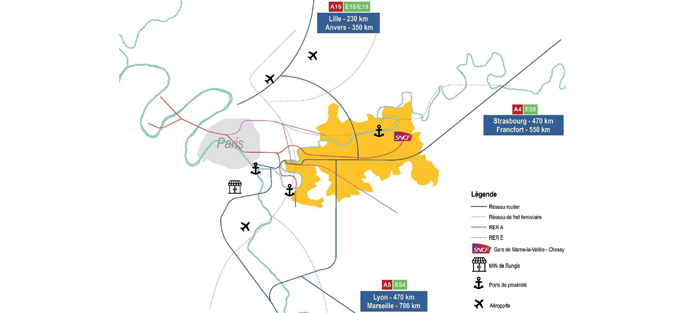

From Marne-la-Vallee to estern Paris' Main HUB : Key figures

Take-up

Recognised as an attractive location that is suitable for small and medium sized businesses and industries, Marne-la-Vallée reaffirmed its dynamics as one of the strongest areas of the Greater Paris Region, as much for small companies as for larger ones (> 3,000 sq.m), which accounted for almost a third of take-up.

Companies benefit from attractive costs, very good access via the A4, the Francilienne and the A86 motorways most notably, as well as the availability of quality premises in which to unite their workforce. The availability of abundant land further permits turnkey developments, following the example of We Connect who are developing 10,800 sq.m in Collégien on the ZAC de Lamirault, and Rubans de Normandie in Serris with almost 3,900 sq.m.

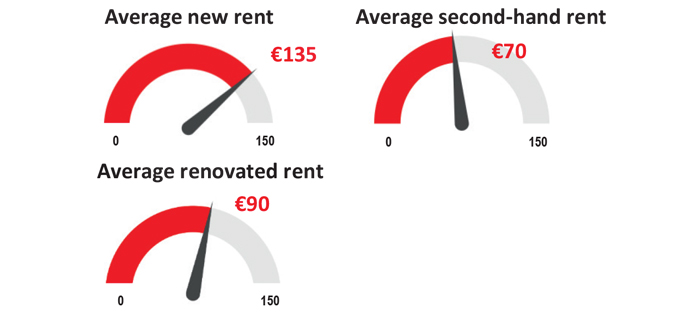

Rents

In 2017, taking into account a reduced sample of letting transactions due to strong owner-occupier activity, the average rent for new light industrial premises was comprised between €100 and €135 excl. taxes and charges/sq.m/year. Renovated premises show a rent of

€90 and second-hand premises reflect a rent of €70.

In 2017, most transactions took place at a rent of between €75 and €100 excl. taxes and charges/sq.m/year.

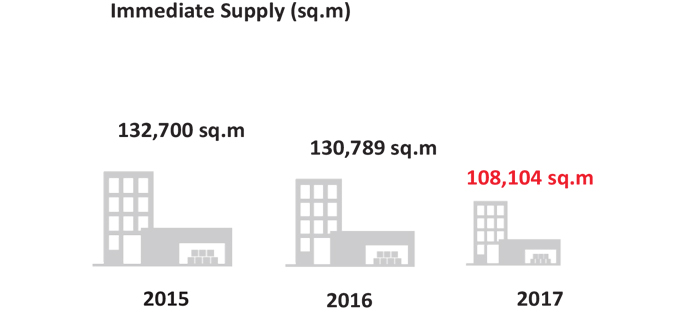

Immediate supply

As at 31 December 2017, only ~110,000 sq.m of light industrial space was immediately available in the Marne- la-Vallée sector, demonstrating the area’s appeal.

New space within the immediate supply has almost disappeared and only accounts for 8% of available areas (compared to 12% in 2016), bearing witness to the appetite of companies for quality premises. The proportion of new space should increase in the future with the development of several light industrial parks in Collégien, Croissy-Beaubourg, Ferrières-en-Brie and Chanteloup-en-Brie, as well as in Serris and Bailly- Romainvilliers.

Future supply

More than 110,000 sq.m of new light-industrial space should be developed by 2020 in Marne-la-Vallée which will animate available supply and meet the needs of companies.

Two thirds of the space that is under development is mainly concentrated in two areas: Marne et Gondoire, including Collégien and Chanteloup-en-Brie where each town will have 25,000 sq.m of new space; and Val d’Europe with the town of Serris, known in 2017 as a new destination for small and medium sized businesses and industries, with the future development of 26,250 sq.m of premises. The dynamism of Bussy-Saint- Georges should not be overlooked either, with 14,600 sq.m still available by 2020. Ferrières-en-Brie will also offer 9,000 sq.m of space between 2018 and 2020.

Proximity to the A4 and Francilienne motorways, the airports, TGV stations and important economic areas make Marne-la-Vallée a particularly appealing place for companies. Furthermore, the skill level of the workforce, the proximity to a quality public transport network (RER A) which will be strengthened in the coming years, the arrival of new metros and a balanced urban environment with a range of housing supply, all combine to make the area one that is sought after by heads of companies and their employees.

« Innovespace, located at the heart of the Chanteloup eco- district, fits in perfectly with our values for the promotion of quality of life and work for users (residents and companies). These workspaces offer flexible, qualitative and visible premises, located in immediate proximity to services, shops and housing, enabling people to drop off their children at day-care in the morning before going to work and to have a choice of restaurants for lunch etc. » (Jean-Christophe Courné-Noléo, President Alsei Group)

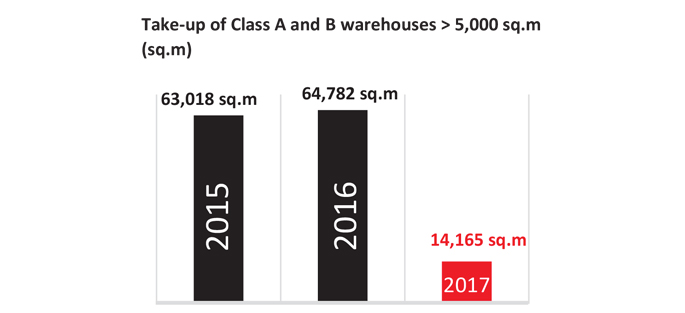

Take-up

In 2017, take-up of warehouses amounted to just 14,000 sq.m. The search for extra-large areas of land is forcing companies to move further from urban centres, and the low levels of available land at a national level is driving companies to keep their current premises for lack of better options.

That being said, there were some significant transactions such as that of 20,000 sq.m let to Viapost in Saint- Thibault des Vignes, and that of Septodont who bought more than 11,500 sq.m in Croissy-Beaubourg. Both of these transactions were for Class C buildings due to a lack of available new assets.

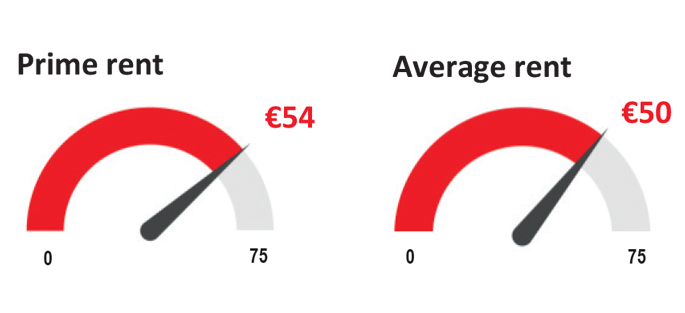

Rents

In 2017, in light of transactions undertaken in the Marne-la-Vallée sector, the prime warehouse rent remains stable at around €54 excl. taxes and charges/sq.m/year, slightly above the Greater Paris Region average.

Immediate and future supply

At the end of 2017, the appetite of companies for the Marne-la-Vallée sector led to a lack of immediate supply of Class A and B warehouses.

However, in order to meet this demand, almost 90,000 sq.m should be brought to market by the end of 2018, with the refurbishment of the former Métro warehouse in Emerainville, and the building of almost 50,000 sq.m of new space in the Val d’Europe sector, 25 minutes from Paris and 10 minutes from the Chessy TGV station. Argan are offering 12,700 sq.m of latest generation space there, and Goodman are also developing 31,500 sq.m there in a new, Class A building with attentive architecture and landscaped surroundings within the Parc d’Entreprises de Val d’Europe.

« Within the ZAC du Couternois, Marne-la-Vallée’s prime logistics sector, Argan is currently developing 12,700 sq.m of Class A warehouse, in line with current standards. It is the ideal place for the headquarters of a prestigious logistics company and their qualified employees.

Furthermore, the Marne-la-Vallée area offers many development, land and real estate possibilities to accompany the development of companies. » (Emmanuel Deport, Sales Manager, Argan)

Market focus by sector

Métropole du Grand Paris

- Transactions : 37,145 sq.m (indus) / 0 (log)

- Nb of transactions : 22 (indus) / 0 (log)

- Proportion of new transactions : 1% of transactions (indus)

- Proportion of sales : 41% of transactions (indus)

- Rents : from €70 to €125 (indus)

- Immediate supply : 10,923 sq.m (indus) / 0 (log)

- Future supply : 0 (indus) / 0 (log)

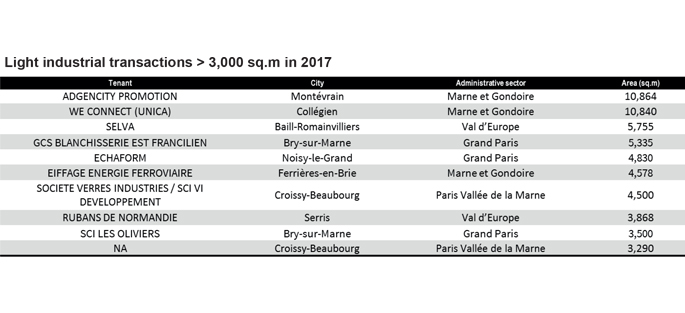

- Significant transactions :

– GCS Blanchisserie Est Francilien – 5,335 sq.m – acquisition

– Echaform – 4,830 sq.m – acquisition

Paris – Vallée de la Marne

- Transactions : 47,912 sq.m (indus) / 7,850 sq.m (log)

- Nb of transactions : 67 (indus) / 1 (log)

- Proportion of new transcations : 3 % of transactions (indus)

- Proportion of sales : 40 % of transactions (indus)

- Rents : from €80 to €95 (indus) / ~€50 (log)

- Immediate supply : 41,944 sq.m (indus) / 0 (log)

- Future supply : 7,500 sq.m (indus) / 45,000 sq.m (log) Significant transactions:

– Société Verre Industries – 4,500 sq.m – acquisition (indus)

– Transmob – 2,795 sq.m – letting (indus)

Marne-et-Gondoire

- Transactions : 86,960 sq.m (indus) / 6,315 sq.m (log)

- Nb of transactions : 88 (indus) / 1 (log)

- Proportion of new transactions : 48 % of transactions (indus)

- Proportion of sales : 63 % of transactions (indus)

- Rents : from €80 to €120 (indus) / ~€50 (log)

- Immediate supply : 47,269 sq.m (indus) / 0 (log)

- Future supply : 69,545 sq.m (indus) / 0 (log)

- Significant transactions :

– Adgencity – 10,864 sq.m – acquisition – turnkey (indus)

– We Connect – 10,840 sq.m – acquisition – turnkey (indus)

Val d’Europe

- Transactions : 28,993 sq.m (indus) / 0 (log)

- Nb of transactions : 27 (indus) / 0 (log)

- Proportion of new transactions : 2/3 of transactions (indus)

- Proportion of sales : 82 % of transactions (indus)

- Rent: ~€95 (indus)

- Immediate supply : 7,968 sq.m (indus) / 0 (log)

- Future supply: 34,756 sq.m (indus) / 44,200 sq.m (log)

- Significant transactions:

– Selva – Parc Spirit – 5,755 sq.m – acquisition (indus)

– Rubans de Normandie – 3,868 sq.m – acquisition – turnkey (indus)

- Étiquettes MIPIM 2018